The Live Near Friends Guide: How to Buy a Duplex

The purpose of this article is to provide a general overview of what’s involved when you buy a duplex with a friend. It is not legal or financial advice. Please chat with a qualified legal, financial, and/or tax professional about your specific situation before making any big decisions.

Duplexes are a great way to live near friends. But how do you actually make it happen?

In this article, we’ll cover the four most common ways to own a duplex, and the financing options, required legal agreements, and exit considerations for each ownership structure.

First: How do you find a good duplex?

Finding a good duplex for sharing with friends can be harder than it sounds. Popular search sites like Zillow don't have the ability to filter by duplex. And when you do find listings for duplexes, it can sometimes be challenging to determine suitability for splitting with friends.

This is why Live Near Friends curates the best duplexes, triplexes, and small compounds for sharing with friends. If one piques your interest, we can connect you with one of our specialist agent partners to advise you.

Ways to own a duplex

The beauty of living in a duplex with a friend is that you get to be as close as possible while still maintaining the separateness of having your own units. But in the eyes of the city, insurers, and lenders, a duplex is seen as one property (unless it’s converted into condos, in which case each unit can be individually sold, financed, and insured).

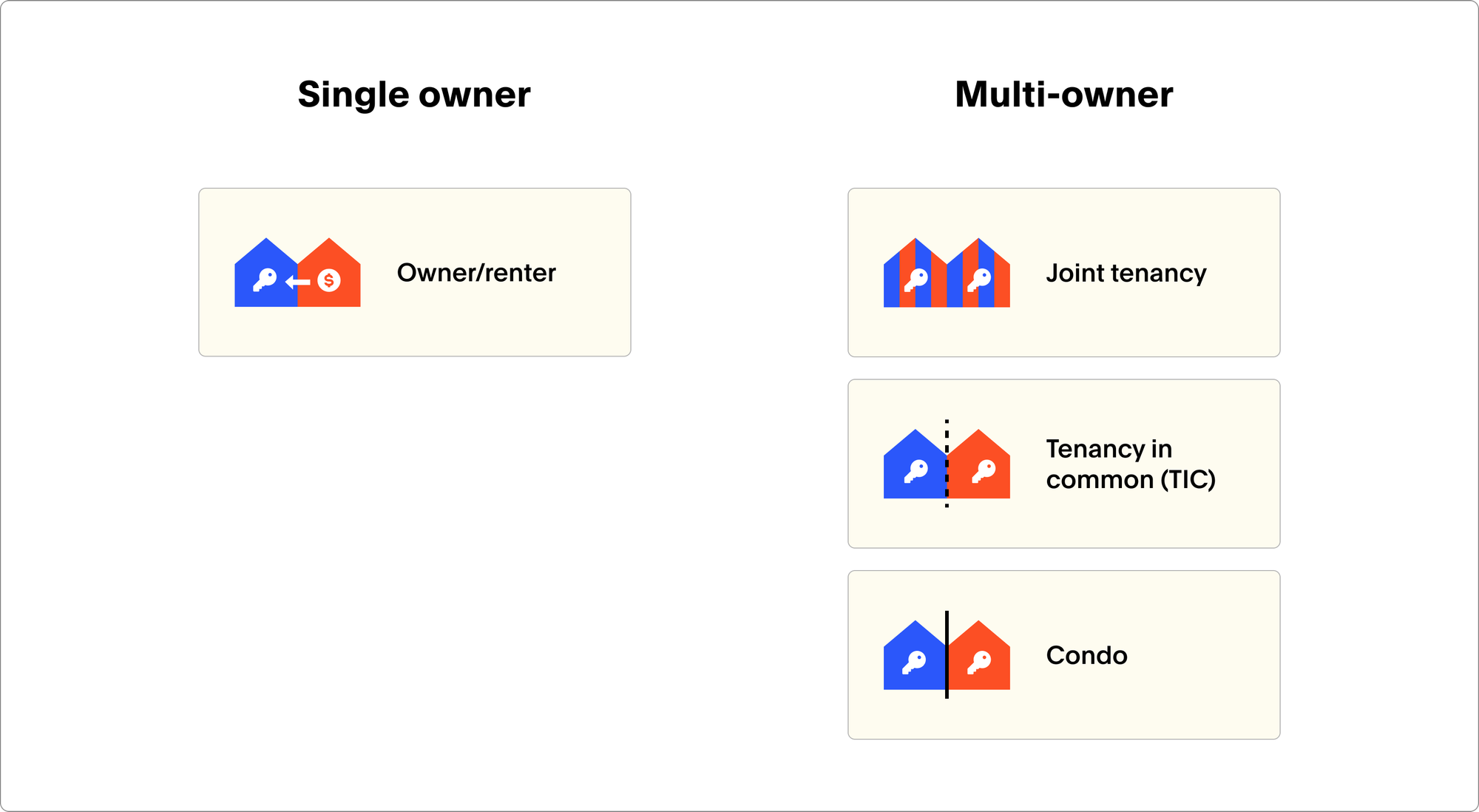

Here are the most common ways we see friends own a duplex:

- Owner/Renter: Friend A owns the entire duplex and rents a unit to Friend B

- Joint tenancy: Friend A and Friend B share ownership of the duplex equally, similar to how a married couple owns property

- Tenancy in common: Friend A and Friend B each own an agreed percentage of the overall duplex, and sign a TIC agreement that grants them exclusive usage rights to individual units

- Condo: Friend A and Friend B convert the duplex into two separately sellable condos and each own one

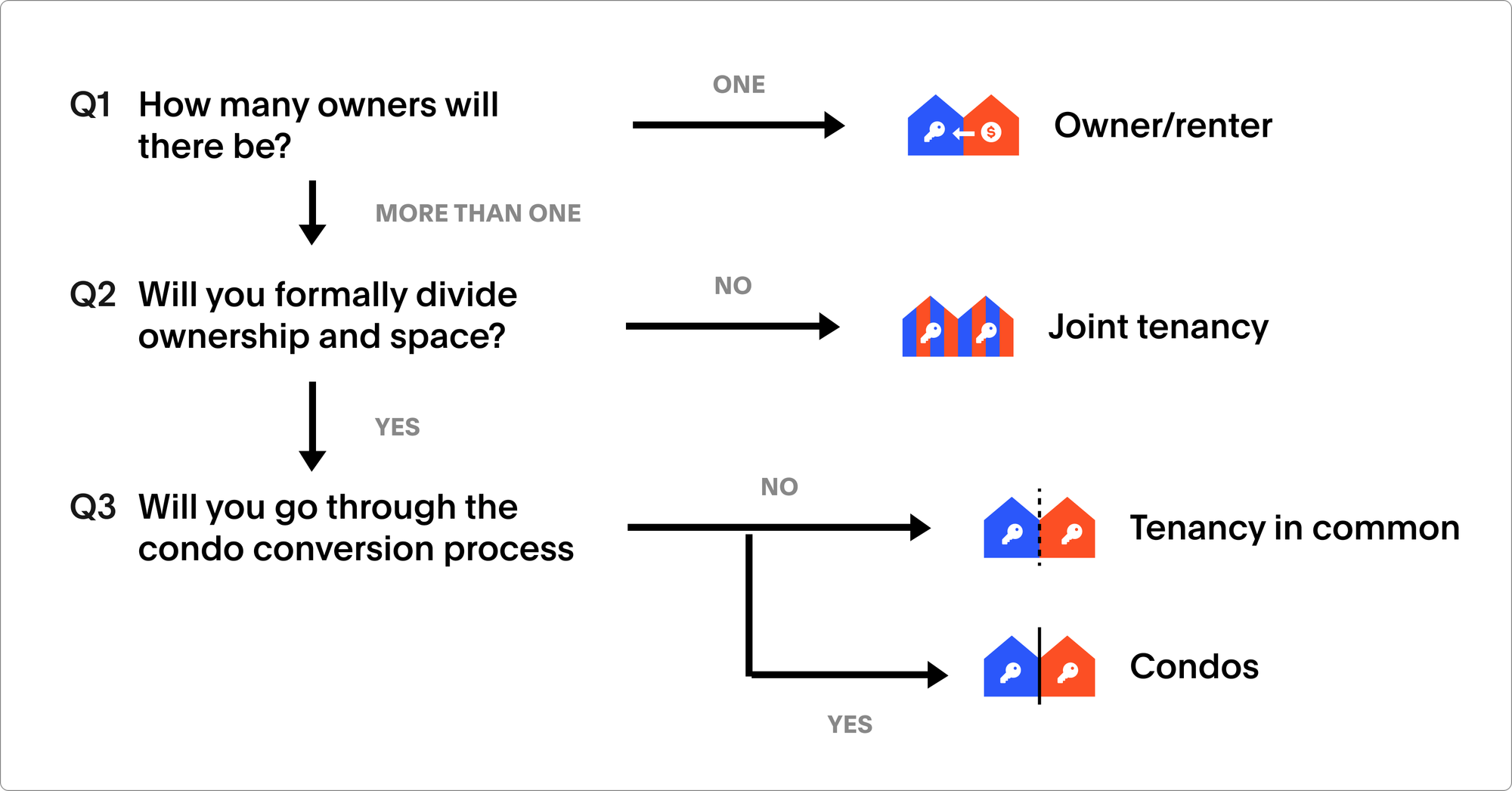

So, how do you pick? We think there are three questions that likely determine the best answer.

Picking an ownership structure: The 3 questions

Question 1: How many owners will there be?

The cleanest and simplest way to own a duplex is to have a single party own it and the other party rent from them (here are some tips for setting rent among friends). This is a great option when one party can afford the downpayment and qualify for a loan on their own and the other doesn’t want to own. It can also make sense when the units are quite disproportionate in size and/or quality.

(Read our case study about The Neighbormune for an example of a successful owner-renter arrangement among friends.)

If you need both parties’ combined financial power to purchase the property – or you simply both want to be owners – you are going to enter a co–ownership arrangement of some kind (joint tenancy, TIC, condo).

The next steps will help you decide which.

Question 2: Will you formally divide ownership and space?

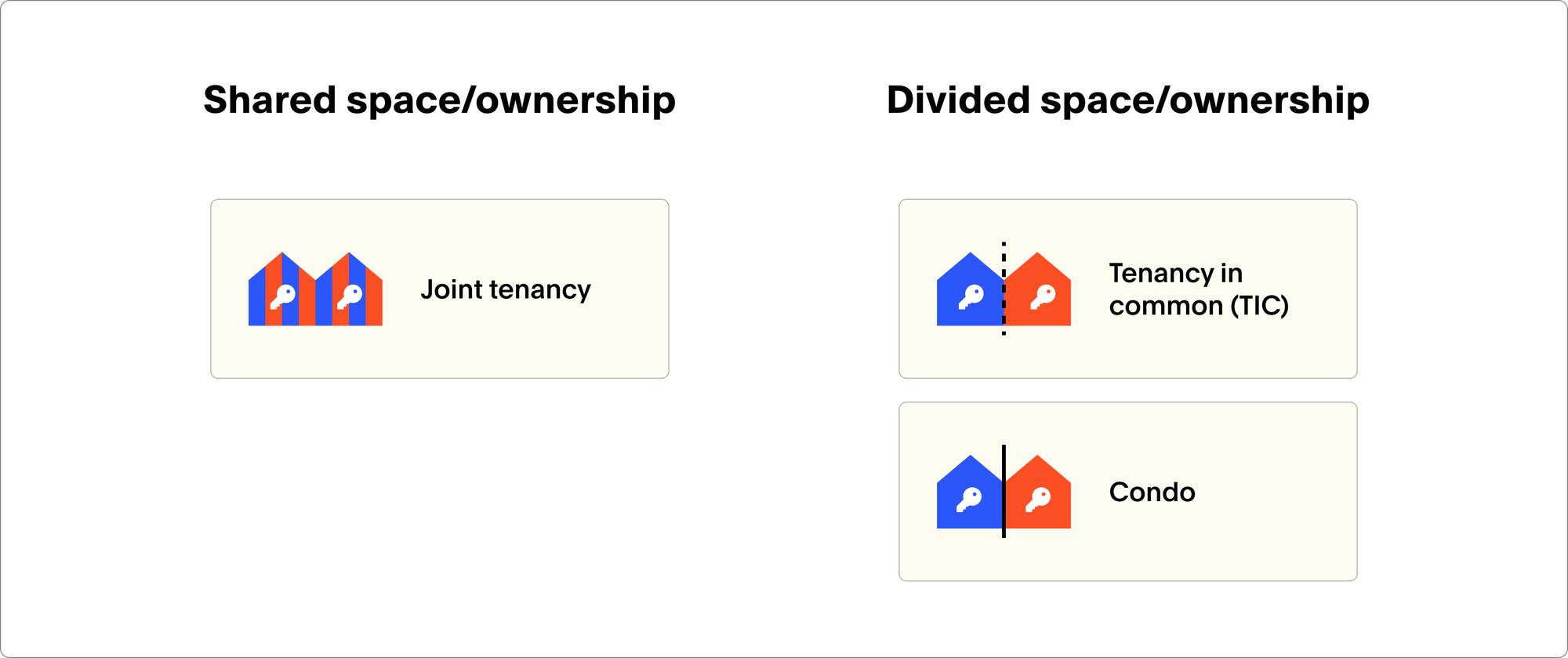

When you’re co-buying a duplex with a friend, you can either:

- Share the space and ownership equally - like a married couple (joint tenancy)

- Formally divide the space and own each unit separately (tenancy in common or condos)

It’s usually cleaner and easier for each of you to own your own unit. But for this to work, all of the following need to be true:

- Each of you plans on living only in your own unit, and this is unlikely to change in the future (you do not intend to swap units)

- Each of you is investing a dollar amount equal to the proportion of the value of your unit (50/50 if the units are roughly equal, or some other breakdown if not).

- Each of you can get financing individually without the help of the other

If the answer to all of the questions is yes, you can skip to the next section to read about the difference between tenancy in common (TICs) and condos.

If the answer to any of these questions is no, then joint tenancy might make the most sense for you. This means jointly owning both units together, similar to how couples own a house together. With a joint tenancy, you can still informally agree to live in the separate units, but both of you technically have full ownership over the entire property.

Reasons to choose this include:

- When one party might not otherwise qualify for a loan or be able to afford a downpayment on their own

- When you want fluidity about who occupies which space over time

A downside of joint tenancy is that even though you may intend to live as two separate households, legally, you’re treated more like a married couple. Because each party holds an equal interest in the property, financial burdens and benefits are also shared equally. Regardless of how much each party invested up front, you’re both equally responsible for the mortgage, taxes, and maintaining good credit standing. If one joint tenant is unable to contribute, the other joint tenant will need to cover their share to avoid default or other financial issues.

(One note: You can also use an LLC in a similar way to joint tenancy, where both of you are owners of the LLC. This can allow you to get around the joint tenancy requirement of equal ownership. In this case, you would still both be “guarantors” of the LLC loan, but could agree to contribute unequally to the down payment or monthly expenses. The only downside here is needing to set up the LLC and create the LLC agreement, which takes time and cost.)

Question 3: Do you want to go through the formal process of dividing the duplex into condos?

If you’ve gotten here, you’ve decided to formally split the duplex into separate units with exclusive use.

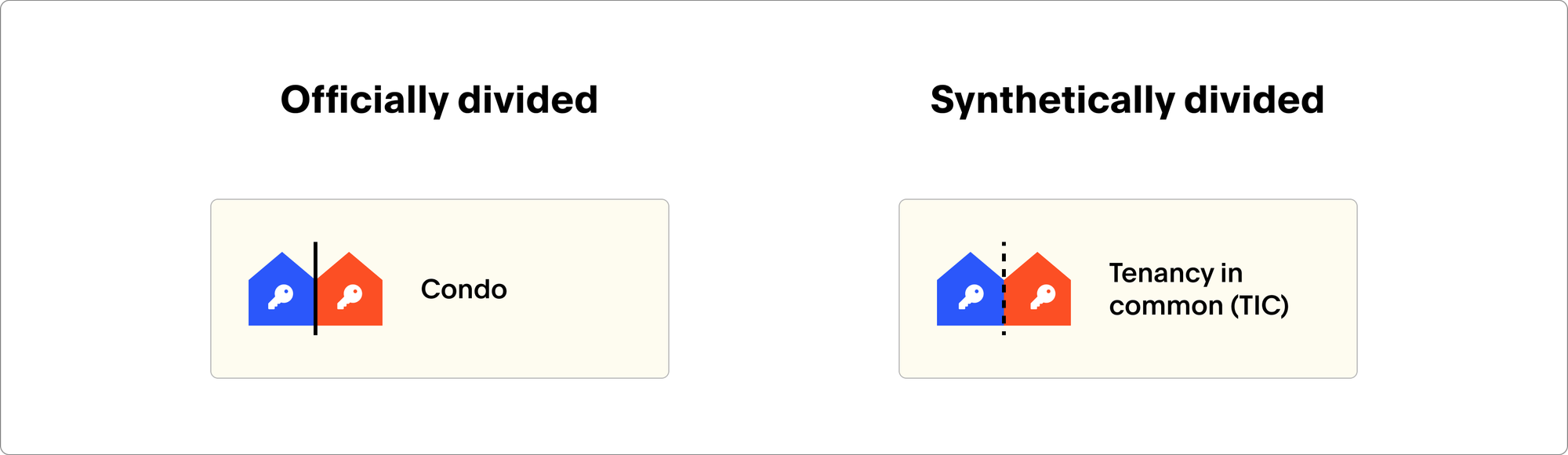

There are two ways you can go about this: tenancy in common (TIC) and condo conversion.

Like condos, TICs allow each owner to have exclusive usage rights to an individual unit within the duplex. But TICs differ from condos in a very significant way: the units within a TIC are not recognized by the city as separately owned and can’t be resold as their own home.

Legally, TIC owners own percentages of the undivided property, rather than individual units. Exclusive usage rights to a particular unit come from a TIC agreement between co-owners — each that they will exclusively occupy their own space. More on TIC agreements below, but for now, the important thing to know is that a TIC agreement is a contract between you and your friend, not the city.

- Tenancy in common: an ownership structure in which two (or more) parties each have exclusive usage rights to an individual unit. As far as you and your friend are concerned, you each synthetically “own” your own unit. But to the city, lenders, and insurers, the duplex is still considered a single property. A TIC is possible for all duplexes.

- Condo conversion: You can go through a process to convert your duplex into two separate condos in the eyes of the city, each of which can be financed and sold separately. But not all duplexes qualify for condo conversion.

In most cases, if you can easily do a condo conversion, you should. Condo ownership offers several advantages over TIC ownership:

- Condos typically sell for a higher price than TICs, and may be easier to sell

- Financing for condos is easier and cleaner than for TICs, which require a special loan

- TICs are riskier than condos. TIC owners rely on a legal agreement rather than deeded rights, making their usage rights potentially vulnerable to challenges. Additionally, TIC owners face credit risks if co-owners fail to pay their share of joint expenses like property taxes and insurance.

But condo conversion isn’t always possible. The following conditions need to be met:

- Condo conversion must be allowed in your city (San Francisco and Oakland either explicitly or practically have condo bans to prevent rental housing being taken off the market)

- You must be willing to spend the time, money, and effort that condo conversion entails

- Your property must meet certain requirements and may need extra work done (at the very least, separating utilities) in order to qualify for condo conversion. You would need to talk to a land use lawyer or architect in your city to explore the specifics here.

- Your property must be easily divisible (it wouldn’t work if you and your friend occupied two floors of a house)

Condo conversion is only possible after you own a property (and in some cases you need a certain amount of time of joint owner occupancy before you can apply) so you need a temporary way of owning it before that happens (a TIC works well for this purpose).

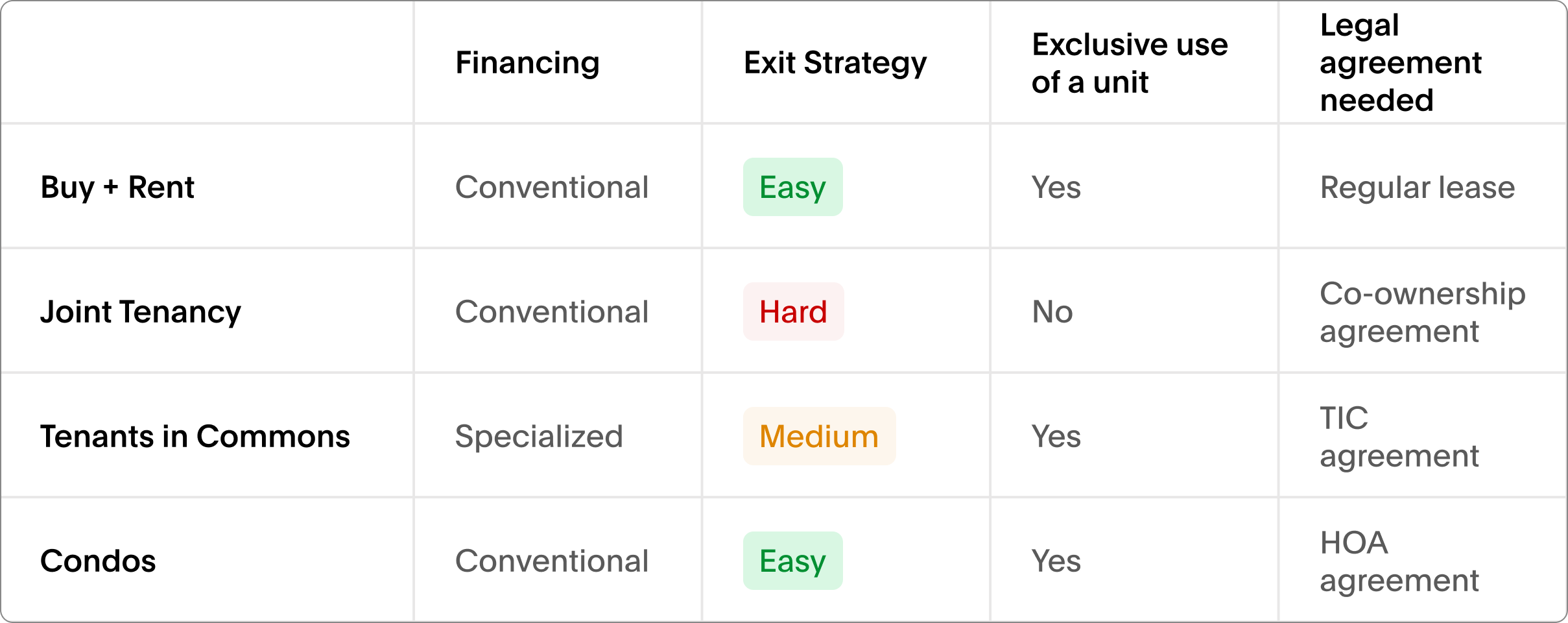

Implications of ownership structures: Financing, legal docs, exit

For each structure, we will now go through the “Big 3” implications.

Financing implications

Essentially, all the structures use “conventional” home loans except for TICs. You can use any standard mortgage calculator to get a sense of costs here.

- Landlord-tenant: the single buyer would get a conventional home loan. Most of the same loan programs for single-family homes are also available for duplexes.

- Joint tenancy: the parties would get a conventional home loan and in most cases both parties would go on the loan together. Their incomes would be added together when qualifying (which allows them to qualify for more) and their credit will be taken together. This is similar to how loans work for married couples. It’s fairly standard to have up to four people on a loan, but having more might limit options.

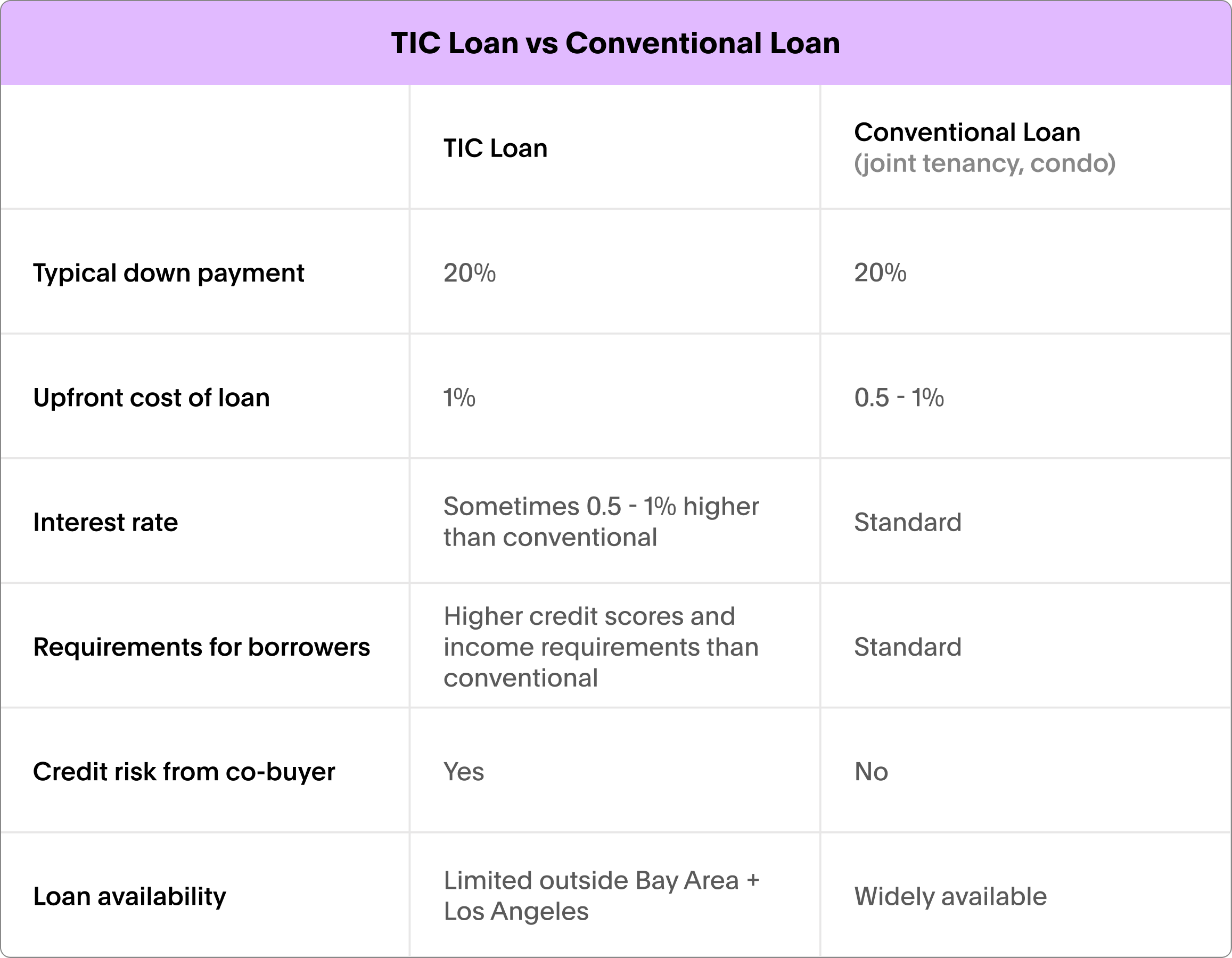

- TICs: typically you’ll need a different category of loan, called a fractional loan. The terms on these are typically less favorable (more on the specifics below).

- Condos: if you’re purchasing two adjacent condos within a duplex, each buyer would get their own conventional home loan. If you are purchasing a duplex with plans to convert to condos later, you will start by financing the whole property and then later refinance into two loans when the condo conversion is complete.

Downsides of TIC Loans According to Expert Brian Elbogen

Most TIC owners get a fractional mortgage, which allows multiple parties to collectively own a property while minimizing risk (one owner’s mortgage default does not imperil the other owners). Individual TIC loans are widely available in the Bay Area, and are becoming increasingly available in other areas.

But separate TIC loans do have some downsides: there is still a financial risk from insurance and property taxes, since these must be jointly paid (if your co-owner doesn’t contribute their share of these costs, it could hurt your credit, you might lose your home insurance, or you might be on the hook for their share). TIC loans may have higher upfront fees than conventional loans, and require higher credit scores and income from borrowers.

Legal agreements required

Your ownership structure will determine what type of legal agreement you need:

- Owner-renter: Conventional lease. Cities and states often have standard lease agreement forms you can use. Here is a California one for example.

- Joint ownership: You will likely want a co-ownership agreement - or at minimum a shared understanding in writing - that outlines each of your rights and responsibilities, decision making processes, and procedures for selling or exiting the co-ownership. This is a private agreement between you and your co-owner.

- TIC: You will likely need two agreements: (1) a deed that stipulates the percentage ownership shares (this is shared with the city), and (2) a TIC agreement that establishes the usage rights for each unit and covers things like management and use of common areas, responsibility for property damage and insurance coverage, and protocols for selling or transferring one’s ownership interest. This is a private agreement between you and your co-owner. There are standard templates for this type of agreement, and lawyers who specialize in creating them.

- Condo: You will likely need a homeowners association (HOA) agreement. This governs the shared maintenance, insurance, rules, and decision making for the overall building and common areas. It also outlines the rights, responsibilities, and financial obligations of each party. This agreement is shared with the city. It’s a standard document that any real estate lawyer can help with.

Implications for exit

At some point, one or both of you may be ready to move on from sharing your duplex. It’s important to consider how easy your ownership structure makes it to exit the arrangement, especially if one party is ready to leave before the other.

One person owns, the other rents: Easy

In this model, exit is straightforward and driven by the party that owns the property. When they are ready to sell, they sell.

If the renter wants to leave, they can just move out and the owner can find someone else (or choose to sell).

Joint tenancy: Hard

Joint tenancy makes it difficult for any one person to exit and sell their share. Both of you need to sell at the same time. This makes it important to have a co-ownership agreement in place that spells out when you would sell and how you would make the decision.

Some states (including California) allow either party to “force” a sale, even if the other person doesn’t want to. In other states, it may come down to what’s in the co-ownership agreement. A co-ownership agreement doesn’t override state law, but makes it less likely that you’ll end up in a situation where one party forces a sale against the others’ will.

Tenancy in common: Medium

In the TIC agreement you will need to decide whether parties can sell their TIC “share” without permission from the other party. You might not allow this (given that it’s a friend arrangement).

And even if you do allow it, individual TIC shares are more exotic and harder to sell than a normal home. In most cases, you will probably be selling to someone in the know.

“It’s common to buy and sell TICs in San Francisco and Los Angeles, but less common in the East Bay and rare outside of those core markets,” said Brian Elbogen, a housing finance entrepreneur and expert on TICs. “TICs are typically sold at a discount of 5 - 20%, depending on market conditions.”

And because the TIC market relies on lenders continuing to offer attractive TIC loans, Brian said there’s also a “remote risk of TICs becoming harder to sell if lenders jack up rates or terms on TIC loans.”

Condo: Easy

Condos are similar to standalone homes. Each party can sell their unit without permission from the other. Though you need to be thoughtful about the impact that is going to have on the friend if you leave, especially if there are shared amenities like a yard.

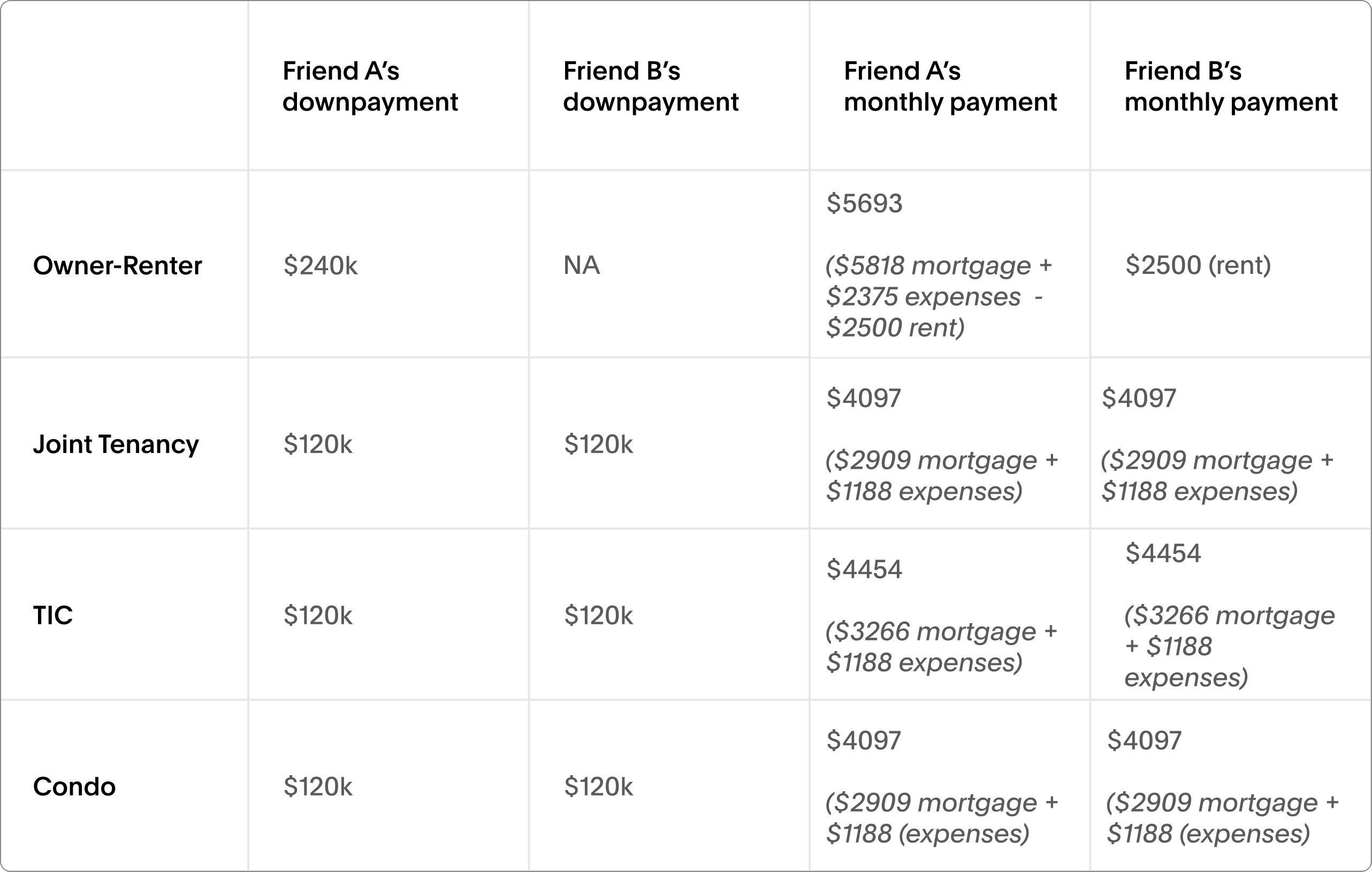

A dive into the numbers: The Duplex at 123 Bestie Row

Let’s break down what each ownership structure looks like for an imaginary $1.2M duplex – located at 123 Bestie Row. We’ll assume the following:

- 20% down payment: $240,000

- Loan amount: $960,000

- Interest rate: 6.1% (except for the TIC loan, which we set at 7.1% to reflect typically higher rates)

- Property tax: $1,000/month

- Insurance: $250/month

- Maintenance: $1000/month

- Other expenses: $125/month

- The two units are of equal size and value

A few notes:

- For the owner-renter structure, we calculated rent using the “Return on Investment” method. Another option is to set rent based on market rates.

- With a joint tenancy, you can informally decide that you want to contribute unequal amounts of down payment or mortgage payments with the other party (for example: If one party is living in a larger unit). But in the eyes of the city and the lender you still both own it equally.

Summary

When thinking through which ownership option is best for you, consider the advantages/disadvantages of each set up.

Live Near Friends is here to help you determine which ownership structure makes the most sense for your specific situation. Reach out to one of our experts to start the conversation.