The ultimate LA guide to living near friends

Hello, LA!

I'm Phil Levin, and I founded Live Near Friends because I saw firsthand how proximity to my closest people changed my life.

After years of the typical spread-out city life, where every hangout required scheduling and traffic, I made the conscious decision to move right next door to my core group of friends by creating a place called Radish.

The change was immediate and profound. My friends cooked dinner for me most nights of the week. Hangouts went from scheduled obligations to unplanned run-ins. And childcare! It feels almost unfair that I get to leave my baby monitor with my neighbor "aunties and uncles" and leave the house at night without a babysitter.

We are absolutely thrilled to be launching in Los Angeles. Housing can be impossible here, but there are hidden gems all over the city if you're willing to consider more creative “multiplayer” housing setups. We surface our favorites every week.

We understand that LA traffic and distance can often be the biggest barrier to connection. This guide is dedicated to helping you build a supportive life where time with your favorite people doesn’t require a trip down the 101.

When you're ready to take the next step, book a free 15-minute consultation call with one of our Live Near Friends Advisors and we can help you figure out how to make it happen.

Table of contents

- 5 ways to live near friends in Los Angeles

- 3 steps for starting the conversation and finding your co-buy squad

- The 6 most common ways to own property with friends

5 ways to live near friends in Los Angeles

Many people who live near friends end up there by luck: they find a home they love, and it happens to be in the same neighborhood as a friend. Or a unit opens up in a friend's apartment building, and they hop on the opportunity to be within Crocs Distance of each other.

But chance isn't the only way to live near friends. Certain property types are an excellent fit for the type of communal life you—and the hundreds of people we've helped—crave.

And in recent years, new California state laws have made living near friends even easier—expanding the types of multi-unit properties that can be built and putting more options on the market for buyers.

These new laws and LA's diverse architecture mean that there are homes for every level of investment, group size, and neighborhood in Los Angeles. You just need to know what to look for.

In this post, we’ll explore the multiple ways to live near friends, from duplexes to custom friend compounds. Keep reading or see them for yourself in our app.

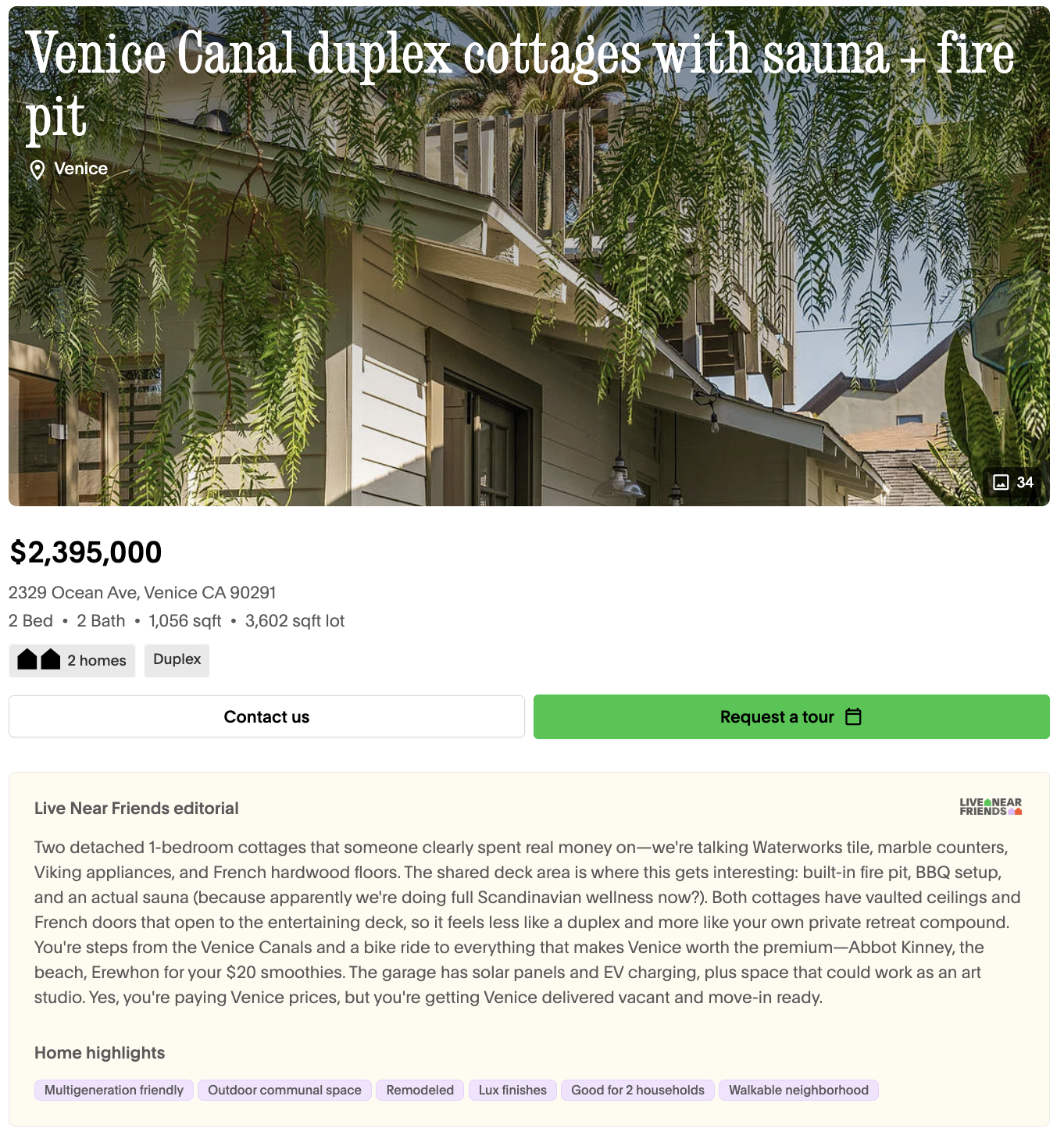

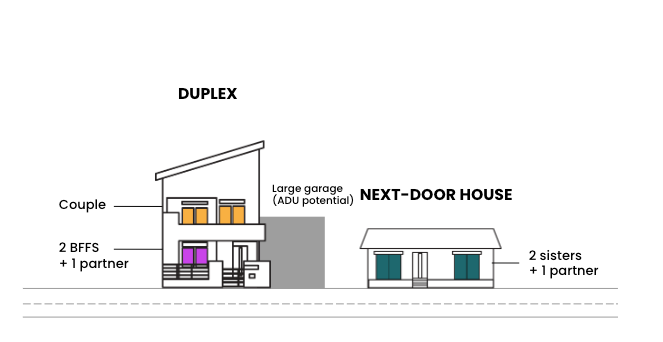

#1: Duplexes

One of our favorite friend-friendly housing types, a duplex is a two-unit residential building. Units are typically stacked side by side or on top of each other, and have the same size and layout.

Best for

Buyers who want a move-in-ready arrangement for living next to friends and family. Because the property is already split, you won’t need to do any additional construction (unless you want to!)

How it works

Duplexes are a popular way to live near and with friends in Los Angeles. As of writing, there are 362 duplexes available on the Live Near Friends app in neighborhoods across the city.

Buying a duplex with a friend allows for all the pros of coliving (a shared yard, spontaneous hangouts, a built-in support system) while maintaining equally sized living spaces and privacy.

One thing to consider: duplexes are typically treated as a single property by insurers, lenders, and realtors, unless they’re converted into condos. You’ll need to think through the ownership structure and plan carefully. It’s also possible for one friend to own the property and rent out the other unit to their friend.

Duplexes on Live Near Friends

Venice Canal duplex cottages with sauna and fire pit

#2 The Mini-hood

A mini-hood is a group of friends or family members who rent or own homes within a 15-minute walk of one another. This is the easiest way to live near friends and involves the least financial entanglement.

Best for

Friends or family who want to buy or rent their own properties but remain within walking distance. Ideal for groups looking for the benefits of shared support systems, impromptu hangs, and easy access to loved ones, without having to agree on one property.

How it works

Building a mini-hood requires coordination, timing, and a bit of luck. If there aren’t multiple properties available near each other (or there are, but they aren’t the right fit), your group might have to stagger your move-ins.

But the benefits are worth the wait. Reed and Mollie, who formed a mini-hood with their families in Durham, North Carolina, said it best:

“We're just in it together. Obviously we have our separate lives which we love, but we support each other. Nothing is transactional. We don’t Venmo each other. It’s not like, “Oh we’re going to take care of their kids because one day they’re going to take care of ours.” We don’t even know if we’re going to have kids.”

Explore a real life mini-hood

Reed and Mollie are friends from college. Eight years later, when Reed was pregnant with her first child, she and her husband, Eric, took a pandemic leap of faith to move near Mollie and her fiancé, Lauren. The two families live a 10-minute walk from each other in Durham, NC.

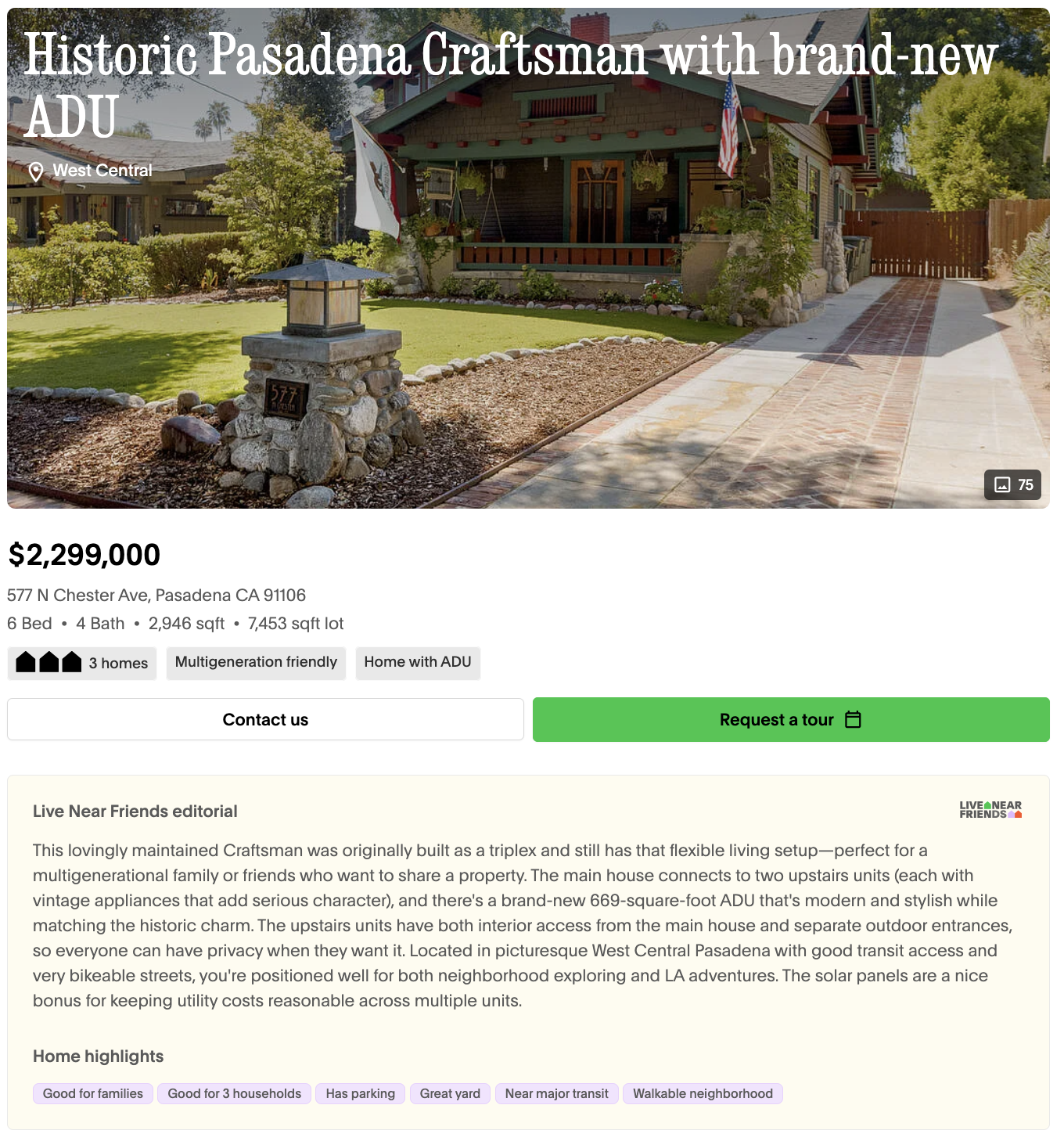

#3 Homes with ADUs

An Accessory Dwelling Unit (ADU) is a separate, smaller home from what’s typically a larger, primary home built on the same property.

We love ADUs for shared living because of the combination of privacy (your own separate home!) and community (your friends are just across the yard). You can buy a home with an ADU or build your own.

ADUs are popular in Los Angeles, where property turnover is low and most (96%) lots are zoned for single-family homes. New laws also make it easier than ever to build ADUs, thereby expanding the number of people who can live on one property together comfortably.

Best for

ADUs are a favorite of multigenerational families. Parents and children can live in a main house, while grandma and/or grandpa enjoy proximity and privacy in a backyard ADU.

How it works

There are a few ways to navigate purchasing an ADU to live near friends:

- One person, couple, or family purchases a single-family home with an existing ADU, with plans to rent it out to friends or family when they’re ready.

- Two groups can co-own the property, coming to a fair split based on square footage and initial investment.

- You can buy a property with a backyard and build an ADU to rent or co-own with friends.

How you decide to split your property will depend on a few factors. Scroll to our FAQ on financing and legal agreements for more information.

ADUs on Live Near Friends

Historic Pasadena Craftsman with brand-new ADU

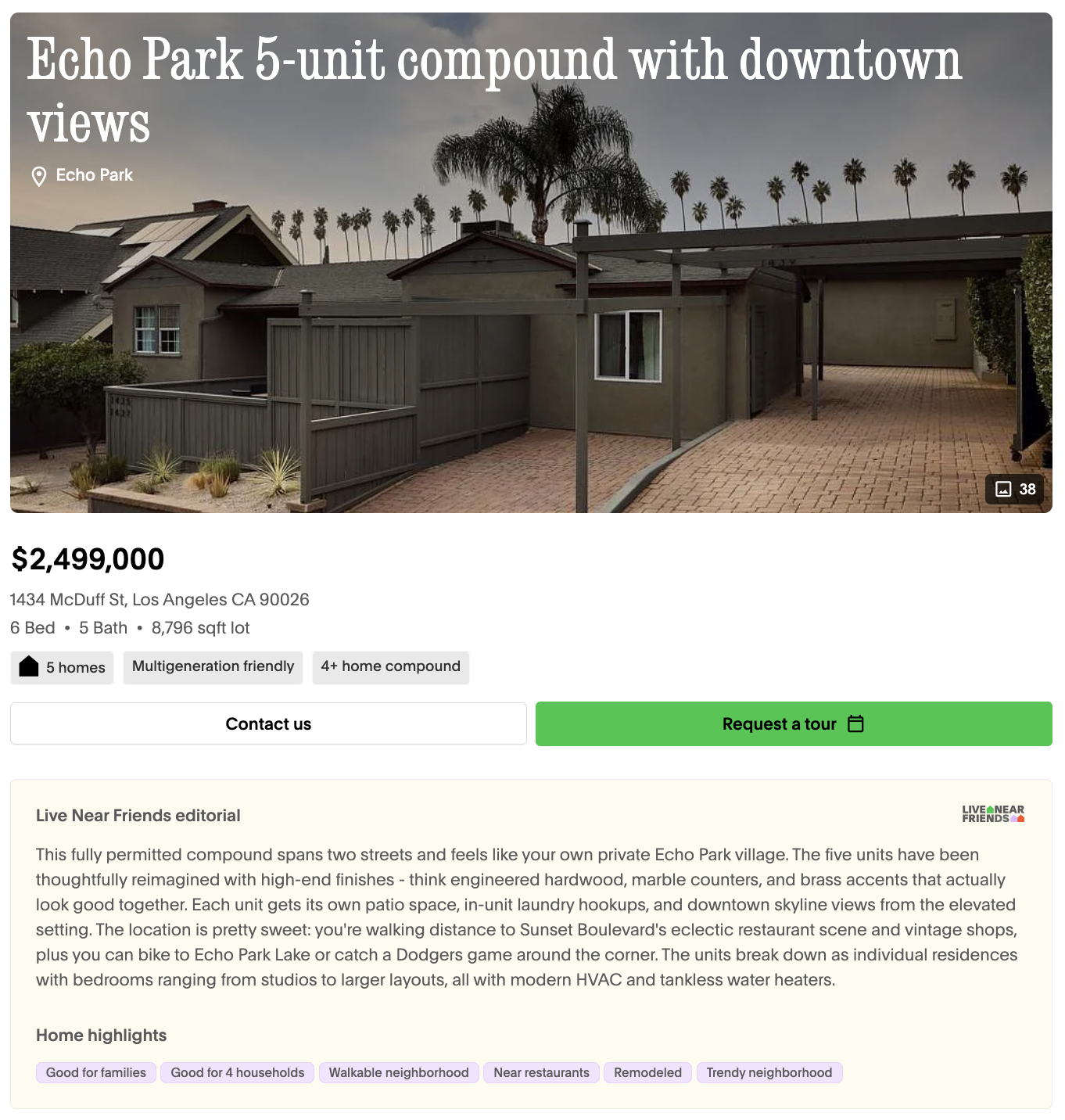

#4 Ready-to-Buy Friend Compounds

Ready-to-buy friend compounds are a way to live with more friends than a duplex or a single ADU allows. These properties are rare in Los Angeles, but they do come on the market occasionally, and we try to highlight them in alerts to our users.

Best for

Ready-to-buy friend compounds are best for large groups. They also allow you to create an owner/renter setup for friends who aren’t ready to purchase yet.

How it works

Thanks to new housing laws, there are various compound configurations in Los Angeles:

- Triplexes with ADUs

- Multiple duplexes on the same lot

- Bungalow courts with multiple small homes

- Purchasing an entire apartment building

Unit size varies. This can be a plus! Not everyone has to commit to the same type of unit, and you can find housing that meets a variety of needs and configurations. On the other hand, most units are limited to 1-2 bedrooms, which might exclude growing families.

The right choice for you will depend on the size of your group, your finances, and sometimes, how comfortable you are with being a landlord to strangers. Many multi-unit buildings are semi-occupied, so you might have to stagger friend move-ins based on current leases.

A Live Near Friends partner realtor can help you find properties that are ideal for shared living, including considerations that regular realtors won’t think of, like parking availability, how utilities are metered, and combinations of private and shared spaces.

Ready-to-buy friend compounds on Live Near Friends

Echo Park 5-unit compound with downtown views

#5 Build-Your-Own Friend Compound

Build-your-own friend compounds are the path to truly custom friends-and-family living. They can take various forms but typically start with a single property or plot of land, then expand to meet a group’s needs.

Best for

They’re ideal for buyers who are ready to commit to the creative (and sometimes financial or legal) challenge of creating their own compound.

How it works

New California state laws SB 9, SB 684, and SB 1211 allow for building multiple dwelling units on one lot, including lots that are zoned for single-family homes:

SB 9 allows owners of single-family lots to split their lots into two or build up to two units on a single lot.

With SB 684, you can buy one lot, divide it into up to 10 lots for friends, and each friend can build a starter home on their own lot.

SB 1211 allows you to build ADUs on existing properties, with a 1:1 unit-to-ADU ratio. That means a duplex can have 2 ADUs, a triplex can have 3 ADUs, and so on.

Building your own friend compound can be incredibly rewarding. After all, you’re creating a home and community for your closest friends! But it requires navigating permitting processes, construction requirements, and the specifics of these new laws, such as maximum size limits.

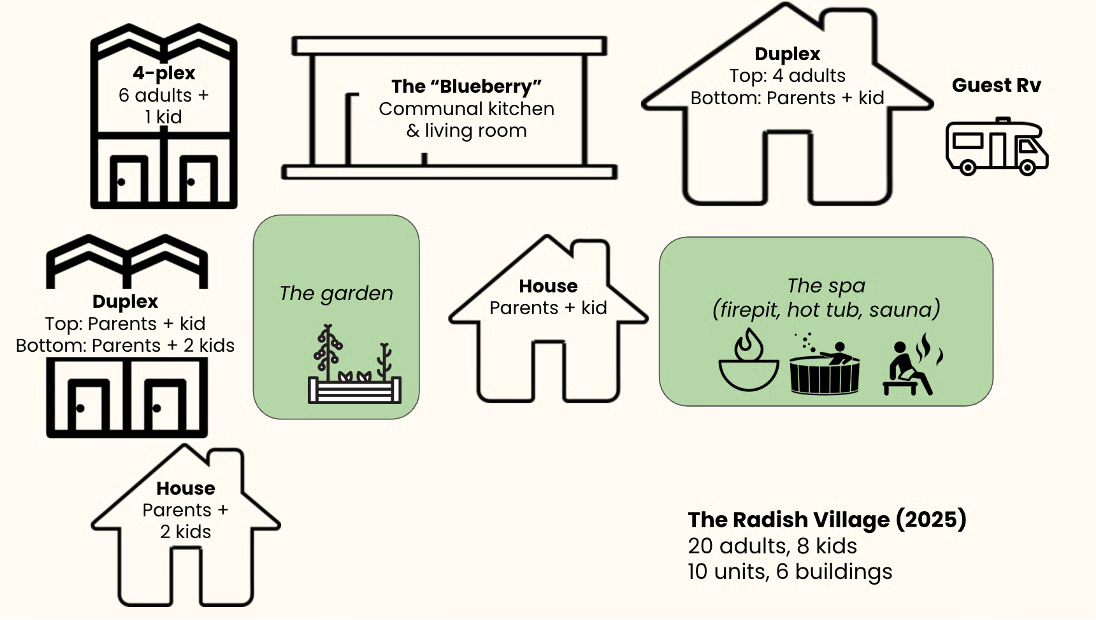

Take a look inside Phil's friend compound in Oakland

Live near friends in Los Angeles

There are so many ways to live near friends in LA, from duplexes and ADUs to multi-unit compounds and mini-hoods. Whether you’re looking for a duplex to split with your best friend or a compound in Venice that the whole family can call home, our team of experts is here to help.

Head to our app to filter through curated properties, connect with a Live Near Friends specialist, and take the first step to turning your fantasy into reality.

More in-depth info on how to live near friends in LA

3 steps for starting the conversation and finding your co-buy squad

Unlike financing a property or creating a legal structure, finding your co-buy squad and getting them on board is a very personal process. There’s no institution to guide you or a template to follow. There’s just you, your friends, and your own judgment.

Until now. This article covers everything you need to know about assembling a group of friends, assessing fit, and moving from fuzzy to firm commitment.

Step 1: Step into your role as “The Instigator”

Many people dream of living near their friends, but few actually make it happen. The key factor in most success stories is the presence of an “Instigator”—someone who decides to take the lead and says, “I’m going to make this a reality” for themselves and their friends.

The Instigator is the person who makes the ask.

If no one makes the ask, nothing gets done. Your friends will start making decisions that are optimal for themselves, but not optimal for the group.

- One friend will move to the suburbs for a yard, not realizing they can have a bigger yard living with you.

- Another friend will move to Sacramento because it’s a bit cheaper, not realizing they could get more for less by living with you.

- Another friend will move near their family for childcare, not realizing that you can help take care of their child.

Before you know it, everyone is locked into their mortgages and elementary schools, and living near friends is a nice idea you all shared in your early 30s, not a practical reality that makes adult life better for the long haul.

The instigator is the solution to this all-too-common dilemma. So, who is The Instigator in your group? If you’re reading this, chances are that person is you. Congrats!

We know it might feel a little uncomfortable to step into this role. But it’s kind of like organizing a bachelor party or a ski trip: sometimes you have to pester people a bit to make it happen, but the end result is completely worth it.

Step 2: Socialize the idea with your friends

This is where you share your desire to live near each other with your friends. It helps if you have a vision, even a hazy one, of what living together could look like and why, even if it’s just a bullet or two.

(When Phil wanted to start Radish, he wrote a rallying cry that outlined his vision and called for others to join him. Check it out for inspiration.)

Now you have something to share with your friends. You can do this in whatever way is comfortable for your friend group, whether that’s casual conversations over coffee, a discussion over dinner, or a simple text message.

The point is to make it clear that you’re excited (and serious!) about this idea and to see if your friends feel the same.

But how many friends should you bring into your vision? That depends in part on the scale of the project you have in mind.

Generally, we recommend 2 - 3x the number of people you ultimately want to live near. If you want to live in a duplex, discuss it with two or three friends. For a triplex, four to six.

The stars aren't always going to align for a specific person, so having a pool of people is a better way to ensure it happens.

Step 3: Finalize your group

Your next step is to narrow the group to a final set of committed participants. To do this, assess group members based on the two big Cs: compatibility and commitment.

How to assess compatibility

If the people you’re considering for your group are your friends, there’s a good chance you’re already compatible in some ways. But being friends and living together, or owning a property together, is a whole other story.

To assess compatibility for living together, start small and work your way up. Some ideas:

- Co-host a monthly dinner for your friend group

- Take a weekend trip together

- Take a 1-2 week vacation together

- Try living together for a month (if you can manage the logistics)

Throughout these steps, pay attention to both what it feels like to plan something together and to spend lots of time with each other. Ask yourself:

- How well do you communicate?

- What do you do when you need space?

- How do you handle disagreements?

- Most importantly, are you having fun, and do you wish you could have more of this in your life?

How to assess commitment

Up until now, you might have only been discussing the idea of living near each other. That’s easy to get on board with—it’s all unicorns and rainbows.

But how do your friends feel about a real-life setup in a specific location, with all the trade-offs that come with it and the work needed to find it?

Step 1. Find a property listing that’s similar to what you might be looking for and calculate what everyone’s potential share might be—whether that’s monthly rent or potential down payment, mortgage, insurance, and maintenance expenses.

Put those numbers in front of your friends and ask if they feel comfortable with it and still want to move forward. If they do, great!

Step 2. Determine whether they’re willing to invest time and money to make this a reality. You can invite them to take a series of escalating steps towards making it happen.

This can include things like:

- Filling out a survey about their housing preferences (check out our list below)

- Taking a weekend to tour properties together

- Getting pre-approved for a loan, either separately or together

- Contributing a few hundred dollars to a housing search fund. This will cover potential search costs such as sharing an Uber to see a house, hiring an architect to look at it with you, or consulting with a lawyer about a contract.

Need an extra push? We can help you start the conversation with friends.

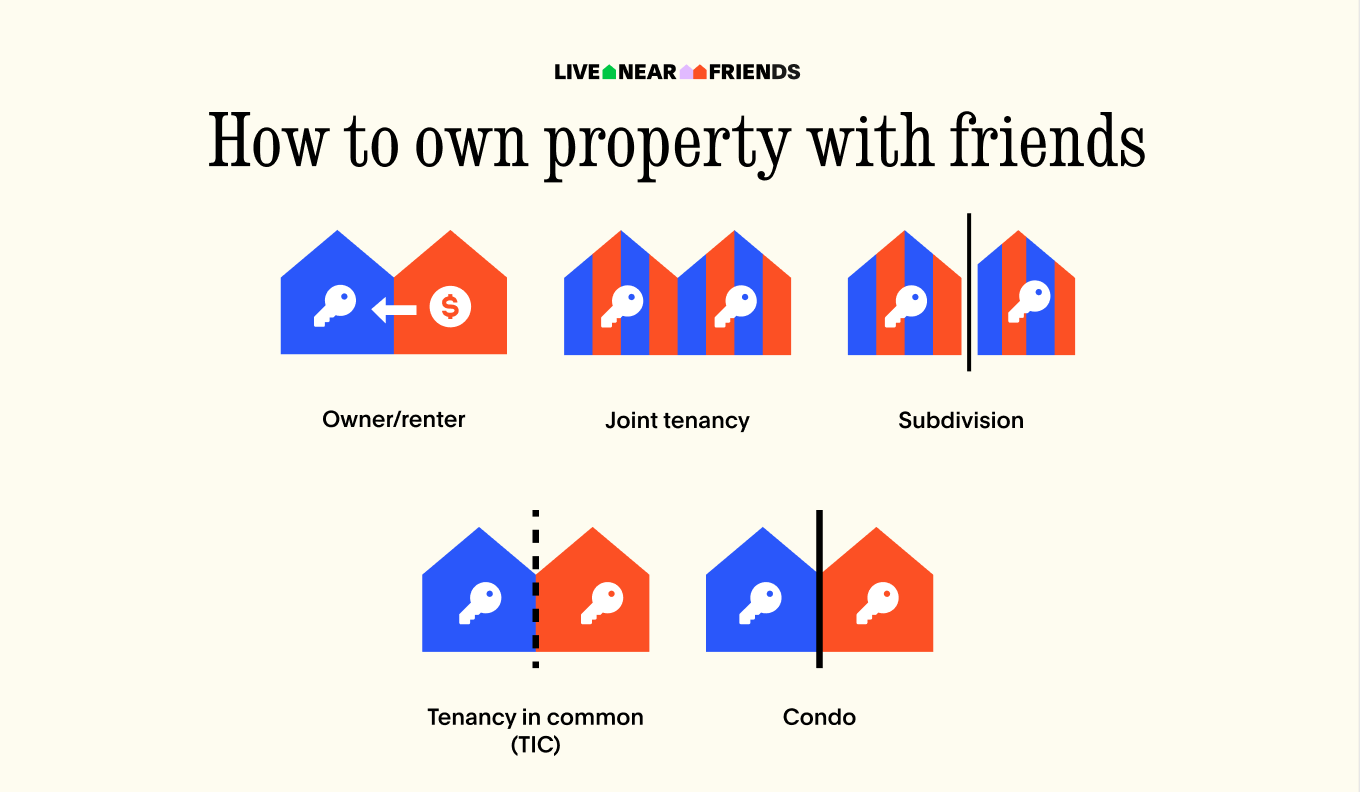

The 6 most common ways to own property with friends

Important note: This is for informational purposes only and is not formal legal or financial advice. Please consult a professional before making any decisions (we can help connect you).

Living near friends, siblings, chosen family, or adult children is one of the most powerful ways to build support, reduce costs, share childcare, and create joy in everyday life.

But once you’ve decided you want to live close, a big question appears:

How should we structure ownership and financing?

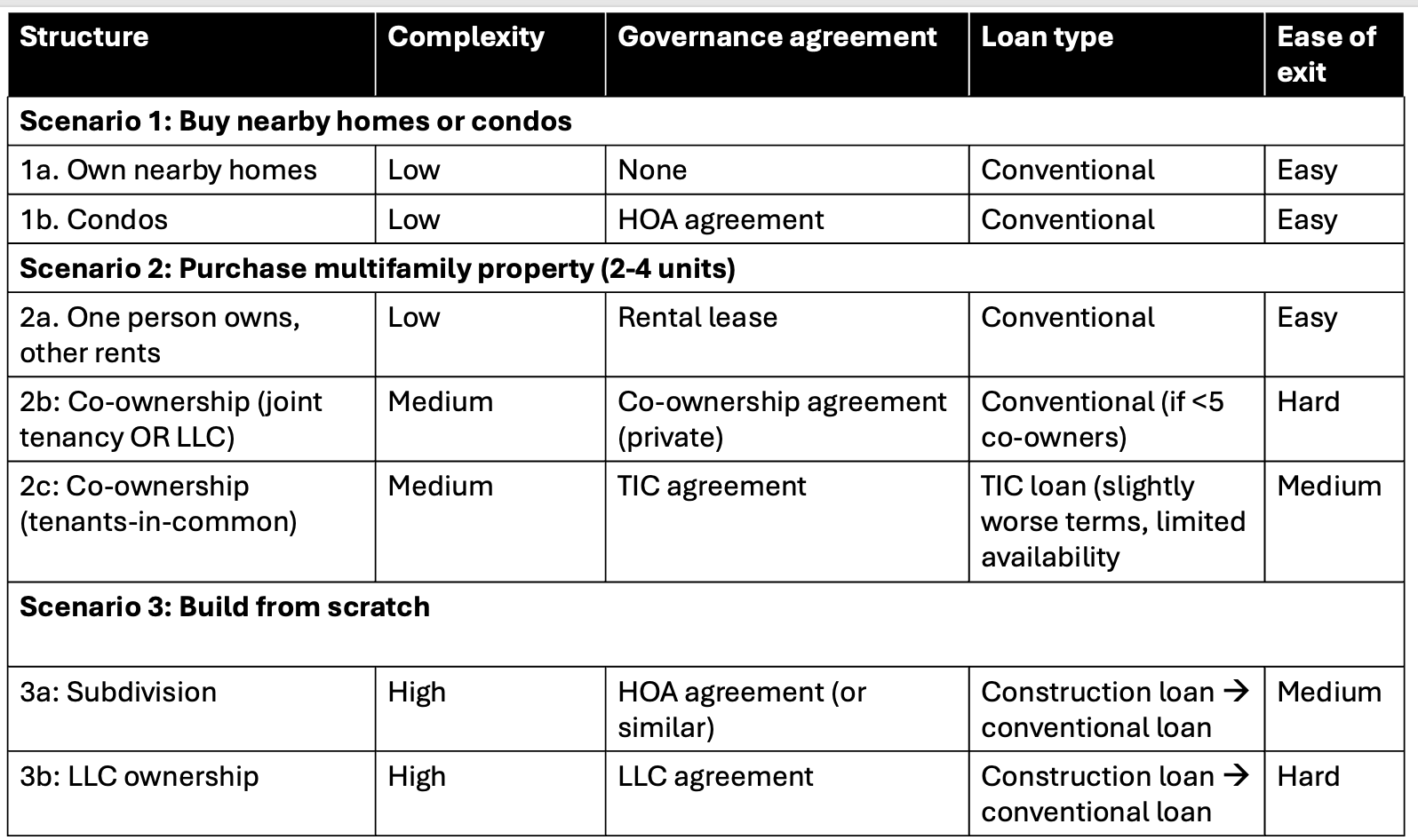

Below are three main scenarios we see at Live Near Friends, from simplest to most complex, with diagrams showing how ownership, mortgages, and responsibilities flow.

Scenario 1: You're buying separate existing homes

The only thing easier than co-owning is… not co-owning.

Our financial and legal systems primarily serve individual owners. If you have a scenario where each household can individually own (or rent) their own home, that's usually the cleanest way to do things.

What kinds of real estate situations allow for this?

A “mini-hood”: Individuals or families buy or rent homes that are within walking distance of each other. Each person owns (or leases) their own home, and you all benefit from being nearby without any shared title or legal structure.

Condos or townhomes: People purchase multiple units in the same building or a cluster of neighboring townhomes that have already been legally divided into separate units, typically with a homeowners association (HOA) in place.

In both setups, each household has its own mortgage or lease, equity, and decision-making power, which in turn allows for the most independence, easiest financing, and lowest complexity.

Downsides to buying separately

Because there’s no shared ownership, you don’t have much control over who lives next door in the future. Your friend or relative can sell their unit to a random stranger, or move away, and the “mini-hood” of friends can fray over time.

Scenario 2: Multi-unit properties

Most Live Near Friends customers are looking to buy or build multi-unit properties. Duplexes, triplexes, and homes with ADUs all fall into this category.

You get the magic of being on the same property in separate units, with varying degrees of shared ownership and responsibility.

There are two common approaches to structuring these scenarios.

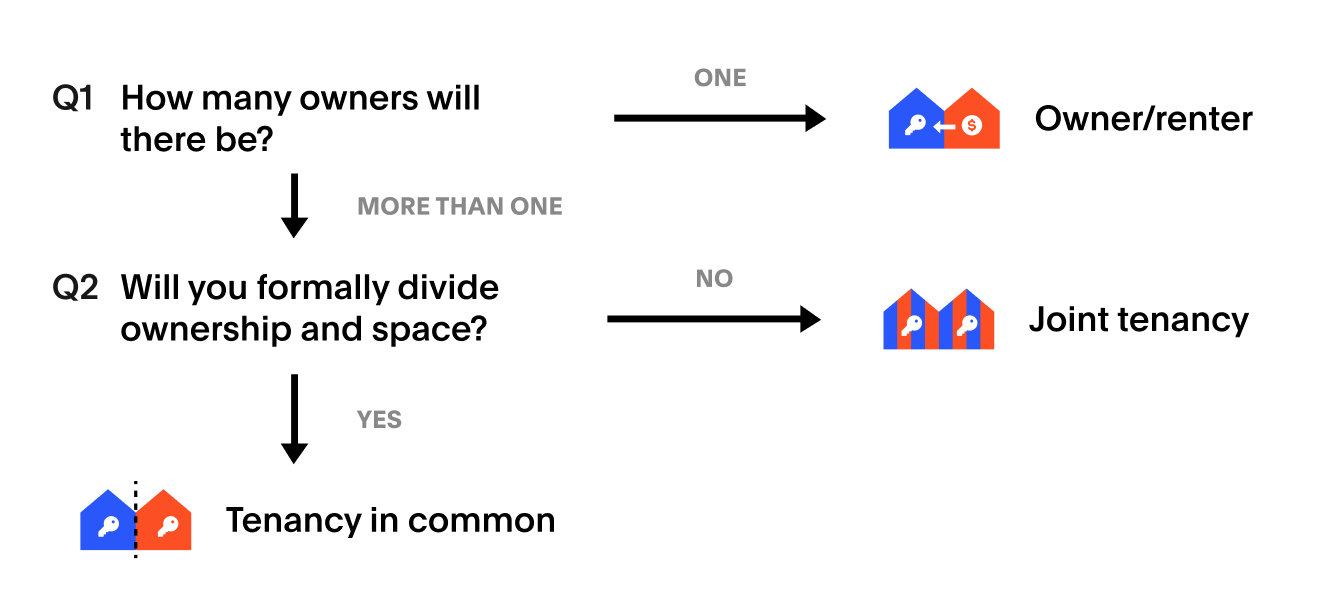

= Option 2A: One person buys, others rent from them =

The cleanest and most straightforward way to own a multi-unit property is for a single party to own it and for the other party or parties to rent from them. (Here are some tips for setting rent among friends.)

This is the single most common way we see Live Near Friends clients live together in a property.

This is a great option when:

- One party can afford the down payment and qualify for a loan on their own, and

- The other party doesn’t want to own, or isn’t in a position to qualify for a mortgage.

It often reflects a practical reality where one friend or family member has more financial resources than another. It can also make sense when the units are disproportionate in size and/or quality. For example, if one is a large 3-bedroom unit and the other is a small studio ADU. Equal ownership can feel awkward in that case.

You might recognize this model from real-world examples, like Sophia and Joe's "Neighbormune" or Xander and Colby's journey to setting up their future friend compound.

The downsides of a buy-rent agreement

If you need both parties' combined financial power to purchase a property, or you simply both want to be owners, this agreement won't work. That's where co-ownership comes in.

= Option 2B: Co-ownership with joint tenancy =

There are two common approaches to co-owning a property with a friend. The first is joint tenancy.

In a joint tenancy, everyone owns the property together on one deed, usually in equal shares. You’re effectively saying, “We treat this building as one shared asset,” even if you mainly occupy different parts of it.

This might be a good fit if:

- You expect fluid use of space—for example, you’re sharing parts of one unit informally, planning to move between units over time, or anticipating using spaces flexibly for guests, offices, or studios.

- You truly want a “we’re in this together” structure, similar to how many married couples hold property.

The downsides of joint tenancy:

It can be harder for any one person to exit on their own. [Explain this]

= Option 2C: Co-ownership with tenancy in common (TIC) =

Another way to co-own with friends is through a tenancy in common (TIC). This is a cleaner approach when each of you has your own unit.

In a TIC structure, you each own a percentage share of the whole property (e.g., 50/50, 60/40), and a private TIC agreement describes who has exclusive use of which unit.

TIC works especially well when all of the following are true:

- You each plan on living only in your own unit, and this is unlikely to change in the future (you do not intend to swap units regularly).

- You are investing dollar amounts proportional to the value of your unit:

- 50/50 if the units are roughly equal, or

- Another split (e.g., 60/40) if one unit is larger, has a yard, better light, etc.

- Each of you can get financing individually without needing the other person’s income or credit to qualify.

TIC can be a very elegant way for friends or family to co-own: each household gets clarity over “their” home while still sharing a single property and a long-term investment.

The downsides of TIC loans (according to expert Brian Elbogen)

Individual TIC loans are available in Los Angeles. And most TIC owners get fractional mortgages, which allow multiple parties to own a property collectively while minimizing risk—one owner’s mortgage default won't imperil the other owners’ loans.

But separate TIC loans do have some downsides.

There is still shared financial risk around things like insurance and property taxes, since these must be jointly paid. If your co-owner doesn’t contribute their share, it could hurt your credit, you might lose your home insurance, or you might be on the hook for their portion of taxes.

TIC loans also come up with different upfront costs and requirements than standard loans:

- TIC loans may have higher upfront fees than conventional loans.

- TIC loans may require a higher down payment (often 25%) vs the standard 20% or the 3.5% of an FHA loan

- TIC borrowers often need higher credit scores and income than buyers of a typical single-family home.

(There are many flavors of tenancy-in-common that we’d be happy to discuss with you, but these are the most common approaches.)

So how do you decide between these structures?

Below is a simplified flowchart to get you started. Or you can book a free 15-minute consultation with our team.

Scenario 3: You're building from scratch together

How exciting! But with great compound comes great responsibility (and a little financial complexity).

In this scenario, you’re not just buying an existing building — you’re shaping the land, the layout, and sometimes even the building designs together.

There are two common ways we see people go about this.

= Option 3A: Subdivision =

One person (or an initial group) buys a piece of land (or land with an existing home), then goes through a subdivision process — potentially using new state housing laws that make small lot splits easier.

After the subdivision is complete, they can sell the newly created parcels (potentially with building plans) to buyers in their friend/family network, who then finance the construction of their own homes on their individual lots.

This often involves getting a "construction loan" to build a new building and then refinancing it with a conventional loan.

This can be a path to a street of friends or a courtyard of houses that are technically separate properties but very clearly part of an intentional community.

= Option 3B: LLC ownership (e.g., the Radish model) =

You can also co-own the whole project as an LLC.

In this model:

- An LLC owns the land and develops the buildings.

- Friends or family members own membership interests (or shares) in the LLC.

- The LLC’s operating agreement governs who can live there, how decisions are made, what happens with shared spaces, and what happens if someone wants to leave.

A model we like for this is the Radish LLC model, which allows for flexible ownership and occupancy. For example, making it easier for someone to move out but stay an investor, or to move in after previously living elsewhere.

The downsides to building from scratch together

These approaches are meaningfully more complex than Scenario 1 or Scenario 2.

You are, in many ways, operating as a real estate developer:

- Dealing with zoning, permitting, design, and construction

- Coordinating multiple homes or units at once

- Managing shared infrastructure like driveways, utilities, landscaping, and common buildings

- Creating and enforcing agreements among multiple households

The payoff can be huge—a custom-designed friend compound!—but the complexity, cost, and timeline are all higher.

The 4 key factors to understand

Each structure can be understood by four key factors: complexity, governance for, loan type, and ease of exit from the relationship.

- Complexity: Owning nearby homes or condos is low complexity, while creating a subdivision would be considered high complexity.

- Governance: Governance determines who owns what and how that ownership is structured.

- Loan Type: A conventional loan can be easier to obtain but harder to untangle from financially than a TIC loan. You'll need to understand your group's broader financial picture to make the best decision.

- Ease of Exit: Exit rules are all about protecting your future selves. If someone needs to move, can they sell easily, or are they stuck until everyone is ready?

These factors matter because they shape how much risk, friction, and emotional load your arrangement will carry over time.

Thinking through them helps you choose an option that fits not just your dream of living together now, but also the messy, evolving reality of life over the next 10–20 years.

Breaking it down

- If you want the simplest path with minimal entanglement, separate homes or condos (Scenario 1) are your friend.

- If you want to be on the same property but keep things simple, one owner + renters (Scenario 2A) can work beautifully.

- If you want to share equity and responsibility and are prepared for greater complexity, co-ownership (joint tenancy or TIC) can make that happen.

- If you want to build a truly custom friend compound and are willing to take on a development-level project, subdivision, or an LLC compound (Scenario 3) may be the path.

Taking the next step

Whichever route you choose, it’s worth:

- Having candid conversations with your group about money, timelines, and long-term plans

- Getting legal advice for any co-ownership, TIC, subdivision, or LLC structure

- Thinking through not just how you start, but how you exit

If you’d like help figuring out which structure might fit your situation, Live Near Friends can walk you through options and show real-world examples of how others have done it.

Why not now?

We believe that life is better when the people you care about aren’t an hour away. If you do too, now is the time to take the next step towards living near friends. And Los Angeles is the perfect place to do it. Imagine: a stronger support system, more spontaneous hangs, and way less time stuck in traffic.

Here are a few low-stakes steps you can take next:

Start a group chat. Send them this guide! See where the conversation goes.

Read our case studies and learn what life can look like when you live close to the people you love.

Explore our Los Angeles properties, and share a few of your favorites with friends.

No matter where you are in your journey to live near friends, we're here to help.